Domain Name Renewal Accounting Treatment

If you cancel a domain name or let it expire it may be deleted by your Registrar. The domain name is treated as an intangible asset because it generates revenue externally through ads or can be sold at a later date.

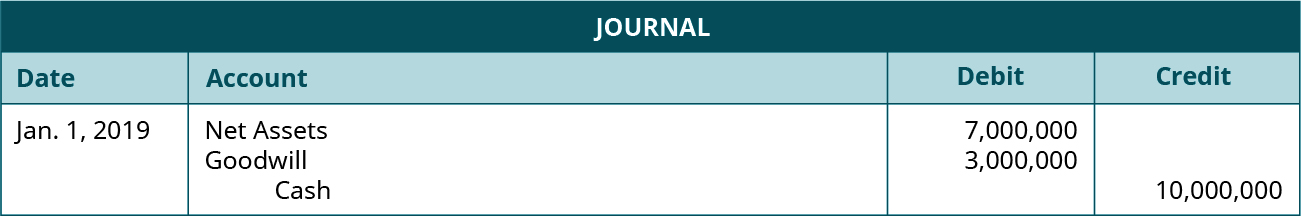

Describe Accounting For Intangible Assets And Record Related Transactions Principles Of Accounting Volume 1 Financial Accounting

Describe Accounting For Intangible Assets And Record Related Transactions Principles Of Accounting Volume 1 Financial Accounting

If the business expects the usefulness of the domain name to end at a certain time it should amortize the domain name over its useful life.

Domain name renewal accounting treatment. In the case eBay France was this domain names registrant but its use was managed by eBay International AG. The FASB Accounting Standards Codification simplifies user access to all authoritative US. The annual renewal fee for registration of a domain name is also deductible.

In this case a domain name that did not appear in the balance sheet was considered fraudulent and gave tax authorities the opportunity to recover eBay France. Such costs are of a revenue nature because they are ongoing in the nature of a servicing charge and are analogous to expenditure incurred in renting space in a building or in hiring goods. General registration added domain name protection services and recurring maintenance costs for a domain name are all considered regular business expenses.

The devil is in the detail. If a domain name is purchased and developed into a brand identity the IRS generally regards the money spent as capital costs that have to be depreciated over time. If it is not restored the domain name will enter into PendingDelete status for 5 days.

Their view is that the domain name is an intangible asset and the cost is not eligible for capital allowances. Internet domain name costs-- capitalized Development stage costs-- apply the rules of AICPA SOP 98-1 Operating stage costs-- apply the rules of AICPA SOP 98-1 Rules of AICPA SOP 98-1 Three stages to develop software 1. Generally accepted accounting principles GAAP by providing all the authoritative literature related to a particular Topic in one place.

I posted tax treatment because as an expense you would be lying about its purpose. The IRS looks at domain name costs in two ways. If you offer accounting services a ACCOUNTANT domain name is perfect for creating a memorable credible online destination for your potential accounting clients.

You may have listed it as an expense for a small business but again that is a poor classification. This acquisition is not part of an acquisition of a trade or business. And while theyre still fairly rare getting access to real working renewal codes is easy.

If deleted the domain name will enter into a redemption period for 30 days under which it remains available to restore. In this case the domain name would be an intangible subject to IRC 167 treatment. This renunciation by a company to renew the domain name so that another may benefit from it against payment of a fee could be said to be a transfer of ownership and therefore an assignment.

Essentially the IRS determined that the costs of acquiring domain names are to be capitalized under Sec. If the business that acquired the domain name is a company the corporate intangible assets regime FA 2002 Sch. We know you didnt have to choose us for your domain name or site builder or hosting plan and we know that we wouldnt be where we are without our loyal customers so renewal codes are just one way we try to reward you.

One domain name is a generic domain name and the other domain name is a non-generic domain name. The cost of the domain name is nothing more than 10 but it can of appreciate in value because its either. Recently the IRS released Chief Counsel Advice CCA 201543014 which provides guidance on the tax treatment for the costs of internet domain names.

Application development stage 3. Similarly the research and planning costs can be included as revenue expenditure. 29 will apply to the cost of the domain name allowing the tax treatment to follow the accounting treatment with a deduction for depreciation if appropriate.

Lastly the CCA warns that if a taxpayer acquires a domain name before a website has been constructed and no goods or services have been offered then the domain name does not meet the definition of an IRC 197 intangible. The company will use the domain names in its trade or business. Capital costs and ongoing recurring business expenses.

263 as intangible assets and that those costs should be amortized under Sec. Businesses organizations and individuals all over the world rely on accounting services for bookkeeping and tax preparation. Usually renewing your domain name wont be any more expensive than the yearly cost you pay for your domain unless you have to buy the domain from a third-party or are renewing for multiple years HostGators domain renewal pricing will range from 095 to 3995 per year depending upon the domain name extension you choose.

The content in the Codification is organized by Topic Subtopic Section. These are deductible from income a business may earn in the same tax year. The costs of a major redesign effectively a replacement of the old website with a new site on the same domain can be treated in the same way as the initial development.

For example say a company purchases a domain name for 10000 and expects it to be useful for 10 years. In 2014 the same company purchases two domain names from existing holders of such domain names. These are capital expenses that can qualify for capital allowances.

197 over a 15-year period. The term authoritative includes all level AD GAAP that has been issued by a standard setter. Hes also right to refer you to your accountant as they are responsible for drawing them up.

The IRS recently released CCA 201543014 the CCA concluding that costs incurred by a taxpayer to acquire certain internet domain names from a secondary market for use in the taxpayers trade or business must be capitalized under section 263 a and amortized over a 15-year period under section 197. Domain names and websites As John says it would be right to include them as assets and therefore show them on the balance sheet of your accounts. Preliminary project stage 2.

The CCA addresses the acquisition of generic and non-generic domain names both in transactions that constitute the acquisition of a trade or business and in transactions that do not ie. In this case the value in a. Post-implementationoperation stage Preliminary project stage.

The business would book an amortization expense journal entry of 1000 once a year for 10 years.

Tax Treatment Of Software And Website Costs The Association Of Taxation Technicians

Tax Treatment Of Software And Website Costs The Association Of Taxation Technicians

Accounting For Website Costs Simple Tax India

Accounting For Website Costs Simple Tax India

Cooperative Society Software Accounting Software Gujarati Patsanstha Software Banking Software Accounting Software Staff Management

Cooperative Society Software Accounting Software Gujarati Patsanstha Software Banking Software Accounting Software Staff Management

Business Accounting Economics Albright College

Business Accounting Economics Albright College

Accounting For Convertible Bonds Debt With Examples

Accounting For Convertible Bonds Debt With Examples

The Accounting Concept Boundless Accounting

The Accounting Concept Boundless Accounting

New Facebook Account Kaise Banaye Accounting Create Photo Find Friends

New Facebook Account Kaise Banaye Accounting Create Photo Find Friends

Hgyukg System For Award Management User Guide Table Of Contents 1 Welcome To Sam 1 1 What Is Sam 1 2 The Federal Procurement World Of The Past And Future 1 3 Who Should Use Sam 1 4 Public User Capability 1 5 Navigating Sam 2 User

Hgyukg System For Award Management User Guide Table Of Contents 1 Welcome To Sam 1 1 What Is Sam 1 2 The Federal Procurement World Of The Past And Future 1 3 Who Should Use Sam 1 4 Public User Capability 1 5 Navigating Sam 2 User

Wifi Embedded In Usb Cables Might Hack You Usb Cables Usb Apple Cable

Wifi Embedded In Usb Cables Might Hack You Usb Cables Usb Apple Cable

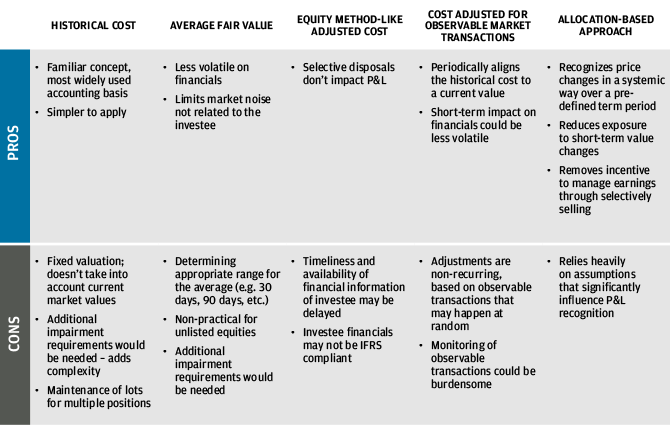

2019 Ifrs Foundational Conference London J P Morgan Asset Management

2019 Ifrs Foundational Conference London J P Morgan Asset Management

Https Www Prcity Com Documentcenter View 27271 August 6 2019 City Council Agenda Item 08

Facebook S Unhackable Twitter And Instagram Accounts Hacked Accounting Instagram Accounts Twitter

Facebook S Unhackable Twitter And Instagram Accounts Hacked Accounting Instagram Accounts Twitter

What Expenses Can I Claim For My Business Website Kf Accounting Services

Asc 842 Ifrs 16 Gasb 87 New Lease Standards Summary

Asc 842 Ifrs 16 Gasb 87 New Lease Standards Summary

Record Expenses With Gst In Purchase Payment Or Journal Voucher

Record Expenses With Gst In Purchase Payment Or Journal Voucher

Environmental Accounting And Reporting Theory And Practice Springer Internal By Free Books Download Issuu

Environmental Accounting And Reporting Theory And Practice Springer Internal By Free Books Download Issuu

Post a Comment for "Domain Name Renewal Accounting Treatment"